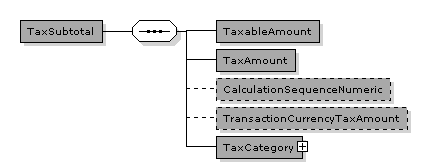

TaxSubtotal

|

|

TaxSubtotal specification

| Name |

TaxSubtotal

(Show as PDF)

|

Alternative Term |

|

| Definition |

Information about the subtotal for a particular Tax Category within a Tax Type such as Standard Rate within VAT |

|

Fields

| UBL-Name |

Name |

Datatype |

Usage |

Cardinality |

| TaxableAmount |

TaxableAmount |

Amount

|

Yes |

1 |

| Definition |

The net amount to which theTax Percent (rate) is applied to calculate the Tax Amount |

| Example |

5050.00 |

|

| TaxAmount |

TaxAmount |

Amount

|

Yes |

1 |

| Definition |

The amount of tax stated explicitly |

| Example |

1262.50 |

|

| CalculationSequenceNumeric |

CalculationSequenceNumeric |

Numeric

|

Yes |

0..1 |

| Definition |

Identifies the numerical order sequence in which taxes are applied when multiple taxes are attracted. If all taxes apply to the same Taxable Amount, CalculationSequenceNumeric will be 1 for all taxes |

| Legal values |

>0 |

| Businessrules |

Used if a calculation sequence is required. |

| Example |

1 |

|

| TransactionCurrencyTaxAmount |

TransactionCurrencyTaxAmount |

Amount

|

Yes |

0..1 |

| Definition |

The tax amount expressed in the currency used for invoicing |

| Businessrules |

Must be used if Tax Currency is different from document currency |

|

|

Subclasses in class TaxSubtotal

| UBL-Name |

Name |

Usage |

Cardinality |

Reference to the printed documentation |

See also |

| TaxCategory |

TaxCategory |

Yes |

1 |

Common Library, 3.101 |

|

| Definition |

An association to Tax Category |

| Datatype |

TaxCategory

|

|

|

Excluded classes and fields in TaxSubtotal

| Name |

Name |

Type |

| Percent |

Percent |

Field |

| BaseUnitMeasure |

BaseUnitMeasure |

Field |

| PerUnitAmount |

PerUnitAmount |

Field |

| TierRange |

TierRange |

Field |

| TierRatePercent |

TierRatePercent |

Field |

|

Example<cac:TaxSubtotal >

<cbc:TaxableAmount currencyID="DKK" >5000.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="DKK" >1250.00</cbc:TaxAmount>

<cbc:CalculationSequenceNumeric >1</cbc:CalculationSequenceNumeric>

<cbc:TransactionCurrencyTaxAmount currencyID="DKK" >10.00</cbc:TransactionCurrencyTaxAmount>

<cbc:Percent >25</cbc:Percent>

<cbc:BaseUnitMeasure unitCode="EA" >1</cbc:BaseUnitMeasure>

<cbc:PerUnitAmount currencyID="DKK" >15.00</cbc:PerUnitAmount>

+ <cac:TaxCategory />

</cac:TaxSubtotal>

|